Explore our EPOS Hardware Solutions

Discover our eCommerce Solutions

Online Payments

Open your business up to new revenue streams with our eCommerce solutions.

Don’t just take our word for how we can help your business…

Manage. Expand. Pivot.

Recent times have shown us that modern businesses have to be both nimble and adaptable. Whether it’s accepting contactless payments from customers or adding eCommerce to increase sales, Clover can provide you with flexible solutions that transform your challenges into opportunities.

What a difference Clover has made to our business! Incredible machines, a pleasure to work with extremely knowledgeable and friendly. Couldn’t have asked for a better service

Holly, Great Britain

Food & Hospitality

Connecting your front and back of house is just one of the benefits of Clover’s tailor-made POS systems that help you deliver an experience your customers love. With portable card readers, you can increase efficiency behind the bar and deliver a faster, smoother service.

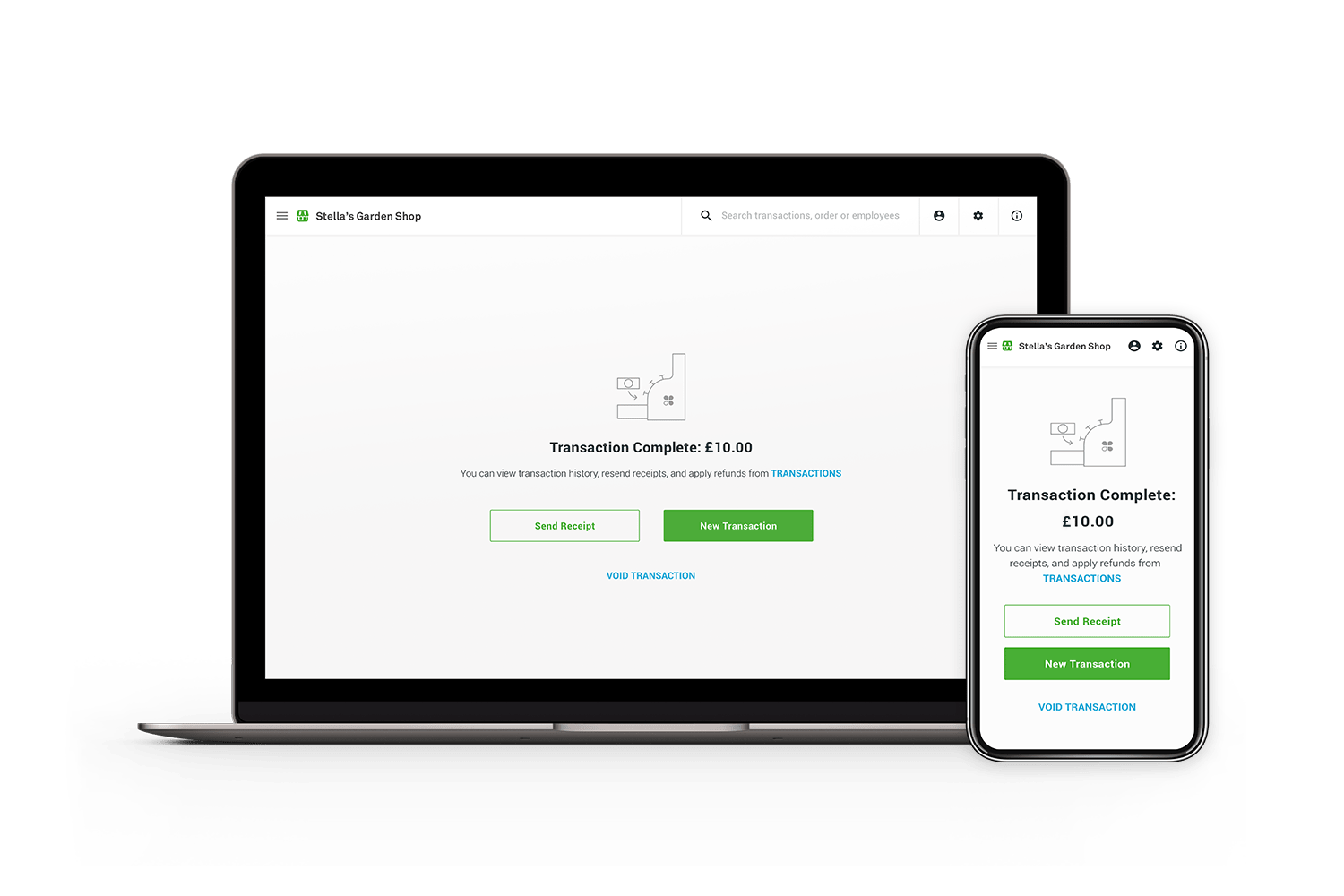

Retail

Keeping on top of inventory and sales at no extra cost is simple with Clover’s intuitive systems, helping you to grow your business, be it in new locations or beyond physical stores.

Health & Beauty

From scheduling appointments to managing inventory, Clover’s flexible POS solutions take the complexity out of your day, so you get to spend the time making your clientele look and feel great.

Get Started Today

Find out more about the benefits of putting Clover at

the heart of your business

Contact Sales

End-to-End Support

With Clover on your side, you get access to our leading UK-based support teams that can help you with anything from initial set up of your card machine to assistance with customisation and troubleshooting.