Fund your business with Clover Capital

Clover Capital is an easy way to access the funds you need, turning your future credit and debit card sales into working capital geared to help your business grow. Our goal is to provide your business the funds to use on anything you need.

Clover Capital is not a loan. It’s an advance of funds based on your future sales.

Fast funding

Get approved in 1-2 business days. Receive funding 2-3 business days later

Automated payments

Pay automatically through your processing. Pay more when your sales are strong; less if sales slow down

No credit impact

No impact to your credit score. No hard credit pull

No personal impact

No personal guarantee

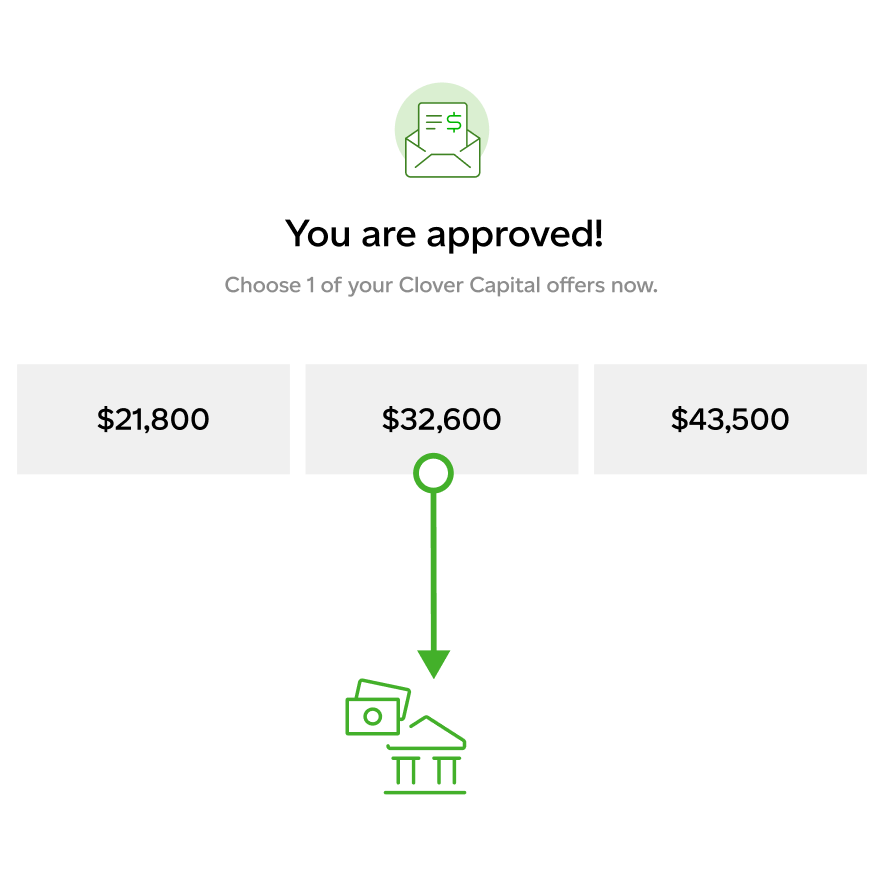

Fast, flexible financing for your business

- Quick and convenientBased on your recent processing history, we will determine the funds you may be eligible to receive in Clover Capital funding. Applying does not affect your credit score.

- How to qualifyYour business must be at least 6 months old with a minimum processing volume of $1,000/month for 3 months. Additional qualifications apply. Terms and Conditions apply.

- Flexible termsA percent of your daily sales is automatically set aside to pay for your cash advance with flexibility. Applying for more capital is even easier once you establish history.

Let’s fund your business

- Increase InventoryRestock popular items to meet your growing demand.

- Upgrade equipmentGet the hardware and equipment you need to streamline your space and operations.

- Hire more employeesStaff up and invest in the people who’ll help take your venture to the next level.

- Amplify your marketingReach a larger audience with smart, creative marketing initiatives.

If I did not have the Clover Capital, I would use my credit card, something I want to avoid,” Russell explains. “I’m in a better place because of Clover Capital, it allows me to use that cash flow to grow my business.”

Janelle Russell

Chateau 4 Paws

chateau4paws.com

Fayetteville, GA

Dog grooming salon

Clover Merchant Since: August 2016

How to Use Clover Capital

Learn more about Clover Capital

Clover Capital on your dashboard

Watch for an email invitation from us, or log into your Clover Dashboard to see if you might be already pre-qualified.