See the credit invisible

Assess, manage, and help reduce risk impact while authorizing more credit-qualified consumers. Built on the TeleCheck database, Alternative Credit Data creates a single customer view based on their identity and bank account information.

Real-time validation means better outcomes

Alternative Credit Data impacts:

- Credit application approvals

- Loan amount, price, and terms

- Management of existing accounts

- Existing evaluation processes

- Collection activities

Create a single customer view with near-term data

Near-term Alternative Credit Data solutions are built on transactional data from the last 24 hours to 90 days. This single customer view is built by uniting approximately 350 million drivers' licenses, 192 million social security numbers, and 450 million bank account numbers.

Real-time cash

availability

Ability and

willingness to pay

Risk and cash assessment

Real-time API

access to data

FCRA regulated

The value of Alternative Credit Data

63M

Number of underbanked U.S. adults

Gain additional insights into the financial activities of consumers.2

7-10%

of consumers are credit invisible

Identify those with active bank accounts and history of successful transactions.1

28%

of U.S. population score below 650

Find the best within the lower-scoring segments. Effectively manage accounts.3

35%

Points Millennials score below average

Millennials use credit differently than older populations. Understand their activity.4

Powerful, comprehensive solutions

Understanding and scoring the full scope of a consumer's behavior helps create a more precise picture of early risk and opportunity indicators compared to traditional scoring. Access account accuracy and status using bank information, allowing Nacha compliance.

Select up to 150 valuable data points

TeleCheck Micro Indicators enable a deep dive into elements that predict credit risk and consumer ability as well as willingness to pay. Gain insight that goes beyond typical data attributes with over 150 micro indicators available for custom analysis and modeling.

Specific Micro Indicator examples:

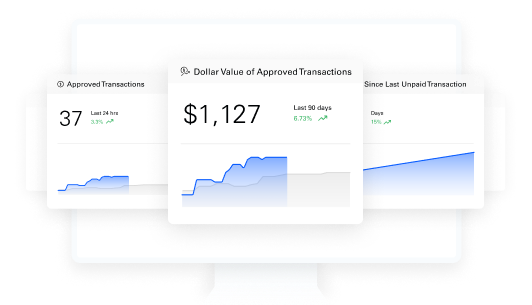

Number of approved transactions: last 24 hours

Dollar value of approved transactions: last 90 days

Number of days since most recent unpaid transaction

Number of days since most recent transaction

Dollar value of internet transactions: last 24 hours

Tell us your vision and we'll bring the solution

We will work with you to understand your business needs and show you how to best leverage our solutions to make your vision a reality.

Sources: 1. Consumer Finance Protection Bureau, “Who are the Credit Invisibles?” 2016, 2. FDIC, “National Survey of Unbanked and Underbanked Households” 2017, 3. Experian, “650 Credit Score, Is it Good or Bad?” 2020, 4. Experian, “Millennial Credit Scores Lag Behind Other Generations” 2020.