Simpler, faster, and more secure payments

Pay by Bank transactions are unaffiliated with card networks, do not require interchange fees, and are backed by guaranteed next-day funding. Boost sales while driving customers to this lower cost ACH payment method, and remove the need to store sensitive bank data.

Why you should think about Pay by Bank

30%

average savings vs. interchange

Reduce transaction processing costs to save on fees.1

100%

chargeback reduction

Minimize fraud and eliminate chargebacks to reduce risk.1

99.5%

approval rating

Grow sales via higher approval rates to increase revenue.1

2X

high-frequency customers

Reward customers who use Pay by Bank to improve loyalty.1

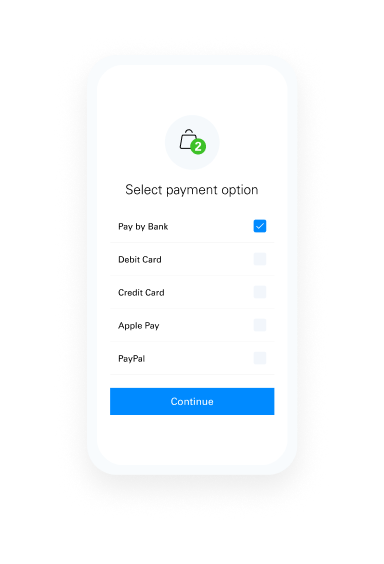

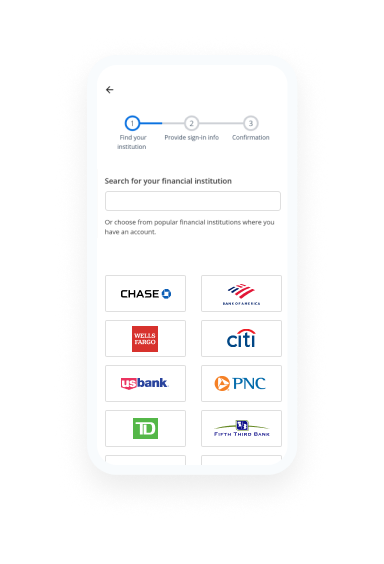

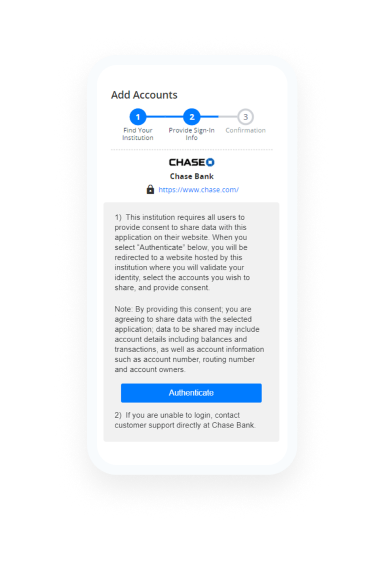

Easily enroll customers

Our one-time enrollment process leverages open banking standards to help ensure a simple, secure customer sign-up experience that can be completed in as little as 60 seconds.

1

Select Pay by Bank

2

Agree to terms and conditions

3

Select your bank

4

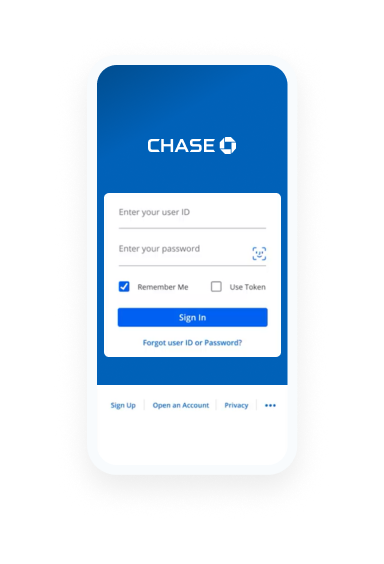

Log in to your bank

5

Select the account

6

Pay by Bank added to wallet

Digital ACH payment channels to fit your business

Link customer bank account payments to everything from payment fobs and loyalty cards to a variety of IOT-enabled devices and recurring payments.

Pay by Bank demand is growing

Open banking, real-time payments, and loyalty are driving adoption of Pay by Bank.

The FedNOW® Service, a new real-time payment service, enables safe and instant money transfer.4

Pay by Bank delivers revenue, savings, and sales results

- National Grocer Success

- Ridesharing Success

- Petro Retailer Success

33%

increase in shopper frequency

A grocery client implemented Pay by Bank, which resulted in a 33% increase in shopper frequency and a 44% increase in average ticket among Pay by Bank customers versus debit users, as well as a 2% lift in top-line sales.

Source: 2021 and 2022 program performance data

Ideas and inspiration

Tell us your vision and we'll bring the solution

We will work with you to understand your business needs and show you how to best leverage our solutions to make your vision a reality.

Source: 1. Client case study in Retail Industry. 48% Pay by Bank users had 4+/trans a month versus 22% for debit users. +30% increase in average ticket; 2. PYMNTS Real-Time Payments Tracker, May 2023; 3. Invesp survey; 4. Fiserv will leverage FedNOW as one of the networks to enable real-time payments.