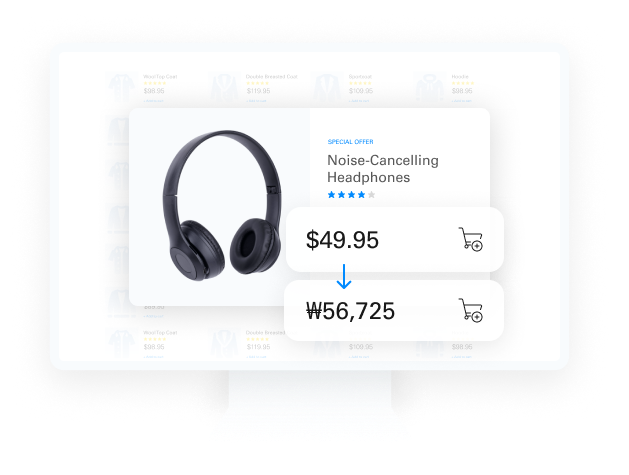

Consumers prefer in-country shopping experiences

of shoppers prefer to pay in their local currency.1

of shoppers will abandon the cart if pricing is not in a familiar currency.1

of global consumers say they’ll do more cross-border online shopping.2

Currency is the language of commerce

Improve sales conversion and reduce cart abandonment by displaying and selling products in currencies that your customers understand. A familiar experience can turn browsers into buyers.

- More currency choice at POS

- Exact purchase price known

- Less confusion & chargebacks

Acquire new customers on a global scale

Make it easy for customers around the world to do business with you. Accept secure and seamless omnichannel payments in 140+ currencies reaching 190+ countries, and receive funding in your base currency.

Ideas and inspiration

Tell us your vision and we'll bring the solution

We will work with you to understand your business needs and show you how to best leverage our solutions to make your vision a reality.

Sources: 1. Shopify, 2. BlueSnap